Toss out the idea of competitive research as a passive, dust-gathering exercise. This guide is all about turning that analysis into a proactive growth engine. We're not just peeking at what your rivals are doing; we're systematically dismantling their SEO, paid media, and conversion strategies to find gaps you can exploit.

The goal isn't to copy your competitors. It's to understand their playbook so you can write a much, much better one.

Your Blueprint for Actionable Competitive Analysis

A truly effective competitive analysis is far more than just casual observation. It’s an active, repeatable system designed to unearth strategic opportunities and threats long before they hit your bottom line. At its core, this process is about gathering intelligence that feeds directly into smarter marketing decisions.

That means you need to start with clear objectives tied to real business outcomes. Maybe you’re an e-commerce brand looking to boost organic traffic, or perhaps you need to improve the quality of your leads. Whatever the goal, a structured approach keeps you from getting lost in a sea of data.

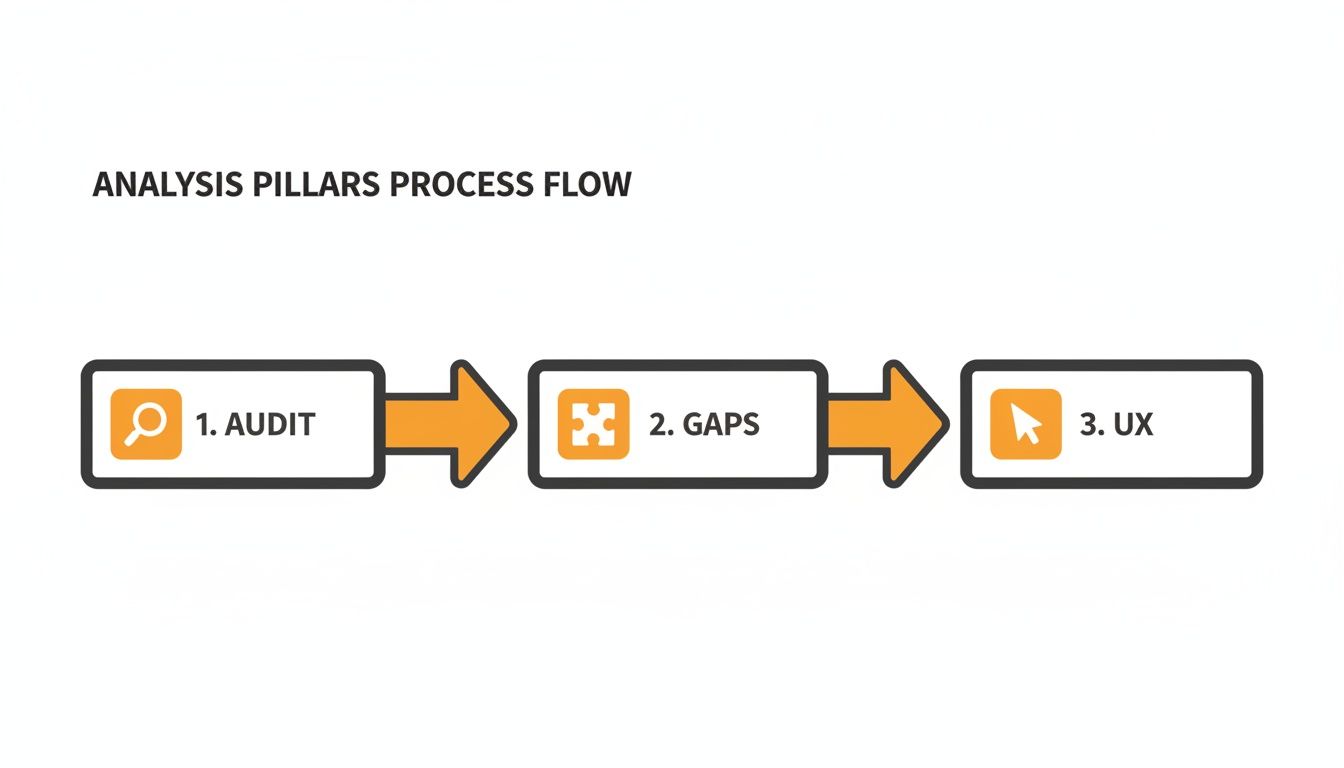

I’ve found the best way to do this is to anchor the analysis around a few key pillars. This gives you a solid foundation and ensures every piece of data you collect has a purpose.

This workflow isn't just a diagram; it's a way to make sure every insight translates directly into a clear roadmap for growth.

Defining Your Objectives

Before you even think about opening a tool, you have to define what victory looks like. Vague goals like "see what competitors are doing" will always lead to vague, unhelpful outcomes. You need to get specific.

Are you trying to claw back market share? Pinpoint features for your next product launch? Or maybe just sharpen your brand messaging?

Your objectives will shape the entire scope of your analysis. For example:

- For SEO: The objective might be to uncover high-intent keywords your top three competitors are ranking for that you've completely missed.

- For Paid Media: You could aim to deconstruct the ad copy and landing pages of rivals who have the highest estimated ad spend in the market.

- For CRO: A great goal would be to benchmark your multi-step checkout process against the seamless experience offered by the top e-commerce players in your niche.

Think of a well-defined objective as your North Star. It keeps your analysis laser-focused on gathering data that actually drives decisions, stopping you from getting dragged down rabbit holes of irrelevant metrics.

Applying a Local and Industry Lens

While the principles of analysis are universal, the real magic is in the application. A generic approach simply won't cut it. For businesses in regulated Canadian sectors like cannabis or CBD, for instance, a standard analysis misses the whole picture.

In these niches, success often hinges on AI-driven SEO and keeping a close pulse on social media trends. We’ve seen businesses that benchmark against market leaders in these spaces achieve 50% faster ranking gains—an absolutely vital edge as Canada's digital ad market continues to explode. You can read more about these digital trends for Canadian marketers if you're curious.

This context is everything. Without it, you’re just collecting data. With it, you’re building a true competitive advantage.

Who Are You Really Competing Against?

Before you start digging into data, let's get one thing straight: who are you actually up against? The answer isn't as simple as just Googling your own product. Your real competitors are anyone fighting for the same eyeballs and budget, and sometimes they don't look anything like you.

Sure, you already know the obvious ones—the companies selling a nearly identical widget to the same people. But if you stop there, you’re playing with a massive blind spot. The digital world is full of indirect and aspirational players who can teach you far more about where the market is headed.

Look Beyond the Head-to-Head Rivals

Thinking beyond your direct counterpart is where the real strategic insights lie. To get a complete picture, it helps to sort your rivals into a few key buckets. Each one gives you a different piece of the puzzle.

- Direct Competitors: This is the most obvious group. They offer a very similar product to your target market. Think Nike versus Adidas. They're your go-to for head-to-head feature, price, and messaging comparisons.

- Indirect Competitors: These guys solve the same customer problem, but with a totally different solution. For a cinema in Vancouver, the competition isn't just other theatres. It's Netflix, the Canucks game, or even a popular new restaurant—they're all competing for that "Friday night out" budget.

- Aspirational Competitors: These are the leaders of the pack. They might not be in your direct competitive set today, but they're setting the gold standard in your industry. Watching them is like getting a masterclass in user experience, branding, and content marketing.

A rookie mistake is getting tunnel vision and only focusing on direct competitors. Indirect and aspirational brands are often innovating faster and revealing new customer behaviours that could disrupt your entire market. If you ignore them, you're only seeing half the playing field.

Let Data Point You to Your Real Competitors

Your gut feelings can only take you so far. To build a reliable list of competitors, you need to lean on hard data from tools that can uncover rivals you didn't even know you had. Platforms like Ahrefs and Similarweb are indispensable here; they turn your assumptions into solid evidence.

For example, the "Competing Domains" report in Ahrefs is a goldmine. It tells you exactly which websites are ranking for the same organic keywords you are. This is one of the quickest ways to identify your true SERP competitors—the sites Google considers your direct alternative.

You might find a niche blog or an industry publication is consistently stealing your traffic for high-value keywords. They may not sell a thing, but they are absolutely competing with you for audience attention. This data can also be a great jumping-off point for learning how to find a sitemap for these domains, giving you a blueprint of their content strategy.

Tools like Similarweb are fantastic for analyzing audience overlap, showing you what other websites your visitors are checking out. This can shine a light on indirect competitors by revealing shared interests and online habits.

A Quick Framework for Sorting Your Competitors

Use this framework to categorize your competitors and prioritize your analysis efforts based on their market role and direct impact on your business.

Competitor Segmentation Framework

| Competitor Type | Definition | How to Identify | Analysis Focus |

|---|---|---|---|

| Direct | Sells a similar product/service to the same audience. | Keyword overlap reports (Ahrefs), manual Google searches, industry reports. | Pricing, product features, messaging, CRO, paid ad copy. |

| Indirect | Solves the same problem with a different solution. | Audience overlap tools (Similarweb), "customers also bought" data, social listening. | Content marketing themes, value proposition, user journey. |

| SERP | Ranks for your target keywords but may not sell a product. | Keyword gap analysis tools, "Competing Domains" reports. | Content quality, on-page SEO, backlink profile, topic authority. |

| Aspirational | Market leaders setting industry standards. | Industry awards, "top brand" lists, high-level market research. | UX/UI design, brand voice, innovative campaigns, customer experience. |

By sorting competitors into these categories, you can move from a disorganized list to a strategic map of the entire competitive landscape.

Nailing Down Your Local and E-commerce Rivals

For businesses with a physical location or a defined service area, the game gets hyperlocal. If you’re a plumber in Vancouver, you couldn't care less about a competitor in Toronto. Your entire focus needs to be on who owns the Google Maps pack for your most valuable local search terms.

The best way to find them? Open an incognito browser and manually search for your core services (e.g., "emergency plumbing Vancouver"). The businesses that consistently pop up in the top three map results are your most immediate threats. Take a hard look at their Google Business Profile, especially their number of reviews and average rating.

For e-commerce brands, the analysis is more about specific product categories. If you sell artisanal coffee beans, your competitors aren’t just other coffee websites. They're also Amazon sellers, subscription boxes, and even high-end grocery chains with a slick online store. Use keyword tools to see who ranks for niche, long-tail product terms—that’s how you’ll spot these specialized players.

Gathering Actionable Intelligence Across Key Channels

Okay, you've got your list of competitors. Now the real work starts. This is where we shift gears from simply knowing who they are to systematically dismantling their digital presence to figure out what makes them tick.

The aim here isn't to just collect a mountain of data points. It’s about gathering real, actionable intelligence. We want to uncover their strategy, see where their budget is going, and understand their priorities across the channels that actually matter. Think of yourself as a digital detective, piecing together clues to build a complete picture of their operation.

Dissecting Their Organic SEO Footprint

A competitor’s organic search presence is basically a treasure map. It shows you exactly which topics they've invested in, what their customers are searching for, and how much authority they've managed to build with Google. This is ground zero for understanding their long-term content game.

Your first stop should be their top-performing keywords. Using a tool like Ahrefs or Semrush, you can quickly see which non-branded terms are driving the most traffic their way. Pay special attention to keywords with high commercial intent—these are the money-makers directly tied to revenue.

From there, a deep dive into their backlink profile is non-negotiable. This tells you who's vouching for them online. Are they earning links from respected industry publications, niche blogs, or local news outlets? This not only reveals their digital PR strategy but also highlights potential link-building opportunities you can go after yourself.

Pro Tip: Don't get distracted by the sheer number of backlinks. What really matters is the quality and relevance. A single link from a top-tier industry journal is worth a hundred low-quality directory links. This quality-over-quantity mindset is what separates amateur analysis from a professional strategy.

Finally, you need to check their on-page and technical SEO health. Are their pages optimized with clear title tags and meta descriptions? Does their site load fast? A quick audit with tools like Google PageSpeed Insights can reveal technical weaknesses that might be holding them back—weaknesses you can exploit. For a more advanced look, you can explore our guide on using AI rank tracking to keep a closer eye on these organic shifts.

Decoding Paid Media and Social Strategies

If SEO shows you a competitor's long-term vision, their paid advertising shows you where they're placing their bets right now. It’s a direct window into their immediate marketing campaigns, target audience, and current messaging.

The Meta Ad Library is an incredible, and free, resource for this. You can see every single ad a competitor is currently running across Facebook and Instagram. Don't just scroll through the images; you need to be analyzing:

- Ad Copy: What pain points are they hitting on? What calls-to-action are they using to drive clicks?

- Creative: Are they leaning on video, static images, or carousels? What’s the overall vibe and style?

- Landing Pages: Where is that traffic going? Is it a product page, a lead magnet, or a blog post? This reveals the true goal of each campaign.

On the social media front, look past the vanity metrics like follower counts. What you're really looking for are engagement patterns. Which types of posts get the most likes, comments, and shares? Are they working with influencers? Monitoring their brand sentiment can also be a goldmine, uncovering how their audience really feels about them and revealing service gaps or product frustrations you can solve.

Winning at the Neighbourhood Level with Local SEO Signals

For any business targeting a specific geographic area, local SEO is the main event. It's where customers are won or lost on a daily basis. A deep dive into your competitors' local performance should start with their Google Business Profile (GBP).

A properly optimized GBP can give a local business up to 70% more visibility in hyper-local searches. That’s a massive advantage.

Your local analysis needs to hit three core components:

- Google Business Profile (GBP) Tactics: How thoroughly have your competitors filled out their profiles? Are they actively using Google Posts, answering questions in the Q&A feature, and uploading high-quality photos? A complete GBP is a huge ranking signal.

- Review Velocity and Quality: Look at how many reviews they have and how often new ones are coming in. Even more important, actually read the reviews. What are customers consistently praising or complaining about? That's direct feedback you can use to improve your own business.

- Citation Consistency: A business's NAP (Name, Address, Phone number) needs to be identical everywhere it appears online. Inconsistent citations confuse search engines and can torpedo local rankings. Use a tool to audit your competitor’s citations and see how clean their digital footprint is.

By digging into these local signals, you can pinpoint exactly how your rivals are building trust and visibility in the community. This intelligence is what you need to build a local strategy that doesn't just compete, but completely dominates.

Uncovering Strategic Gaps and Opportunities

So, you’ve gathered all that competitor intelligence and now you’re staring at a mountain of raw data. This is exactly where most competitive analysis efforts lose steam. Data without interpretation is just noise; the real magic happens when you turn that raw intel into a concrete action plan.

This is the part where we shift from just observing to actually strategizing. We'll use a few trusted frameworks to pinpoint your competitors' real strengths and, more importantly, their weaknesses—the kind you can drive a truck through. It's time to connect the dots.

Applying a Modern SWOT Analysis

The classic SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is still a fantastic starting point, but it needs a refresh for the digital marketing battlefield. A modern SWOT doesn't just list vague points; it forces you to tie every single observation directly to your online performance.

Forget broad statements. Get granular with the data you just collected.

- Strengths: A competitor’s high Domain Authority isn't just a "strength." It’s a direct result of their stellar content and savvy link-building. Or maybe they have consistently high engagement on their Instagram Reels. That’s a specific, powerful strength.

- Weaknesses: Is their site painfully slow to load? That’s a technical SEO weakness ripe for exploitation. Is their Google Business Profile a ghost town with no recent posts or Q&As? That’s a glaring local SEO vulnerability.

- Opportunities: Your analysis might show they completely ignore long-tail keywords. This is your cue to create hyper-targeted content that scoops up all the high-intent traffic they're leaving on the table.

- Threats: A new, well-funded competitor suddenly bidding aggressively on your top keywords is a direct threat to your paid media ROI and needs immediate attention.

A digital-first SWOT isn't about filling in boxes. It’s about translating every data point into a competitive advantage or disadvantage, turning abstract metrics into a tangible battle plan.

Executing a Keyword Gap Analysis

One of the most powerful things you can do right now is a keyword gap analysis. This process is all about identifying valuable, high-intent keywords that your competitors rank for, but you don’t. Think of it as finding a treasure map where they've already done most of the digging for you.

Tools like Ahrefs or Semrush are your best friends here. You can plug in your domain against a few top competitors, and the tool will spit out a list of keywords where they have all the visibility and you’re nowhere in sight. But your job doesn't end there.

The real skill is filtering this list for relevance and, most importantly, user intent. You're hunting for terms that scream a user is ready to learn, compare, or buy. For example, if you sell hiking boots and a rival ranks for "best waterproof hiking boots for rocky trails," that's a massive opportunity you simply can't afford to ignore. Creating a better, more in-depth piece of content for that exact term allows you to intercept their qualified traffic.

This process also shines a light on internal issues like keyword cannibalization, which happens when you have multiple pages fighting for the same term. You can learn more about how to avoid keyword cannibalization to make sure your content strategy is running as efficiently as possible.

Finding Gold With a Content Gap Analysis

While a keyword analysis is zoomed in on specific search terms, a content gap analysis pulls back to look at the bigger picture of topics and themes. Your audience has problems to solve and questions that need answering. This analysis helps you find which of those questions your competitors are answering that you've totally neglected.

Start by mapping out your competitors' content hubs—their blogs, resource centres, and FAQ sections. What are the recurring themes? Are they publishing ultimate guides, in-depth comparison articles, or compelling case studies that you simply haven't touched?

For instance, if you're a B2B software company and notice your main rival has an entire library of articles about "integrating with X platform," and you have zero content on the topic, that's a huge content gap. It tells you they understand a key pain point for the audience, and they’re positioning themselves as the go-to solution. That's invaluable intel for your own editorial calendar.

Turning raw data into a coherent strategy requires structure. Analysis frameworks are the bridge between collecting information and making smart decisions. They help you categorize your findings and see the patterns that lead to real breakthroughs.

Below is a quick-reference table of the key frameworks we've discussed and the tools that make executing them much more efficient.

Key Analysis Frameworks and Tools

| Analysis Framework | Objective | Key Metrics to Track | Recommended Tools |

|---|---|---|---|

| SWOT Analysis | To categorize internal strengths/weaknesses and external opportunities/threats. | Domain Authority, page speed, social engagement rates, backlink quality, top keywords. | Ahrefs, Semrush, Google Analytics, your own business data. |

| Keyword Gap Analysis | To find high-value keywords competitors rank for that you don't. | Ranking position, search volume, keyword difficulty, cost-per-click (CPC). | Ahrefs' "Content Gap," Semrush's "Keyword Gap Tool." |

| Content Gap Analysis | To identify entire topics or content formats you're missing compared to rivals. | Content types (guides, blogs, videos), topic clusters, publication frequency. | Ahrefs' "Content Gap," BuzzSumo, manual site audits. |

| UX/CRO Audit | To evaluate how effectively competitors convert traffic into leads or sales. | CTA clarity, form length, mobile usability, use of social proof, checkout friction. | BuiltWith, Hotjar, manual funnel walkthroughs, PageSpeed Insights. |

These frameworks aren't meant to be rigid checklists but rather flexible guides. The goal is to use them to organize your thoughts and ensure you're looking at the competitive landscape from every important angle before you commit to a new strategy.

Auditing Competitor UX and Conversion Triggers

Traffic is great, but conversions are what pay the bills. A crucial—and often overlooked—part of any solid competitive analysis is auditing the user experience (UX) and conversion rate optimization (CRO) tactics of your rivals. How are they so good at turning casual visitors into paying customers?

You have to systematically walk through their key conversion funnels. Go ahead and sign up for their newsletter. Add a product to their cart and go all the way through the checkout process. As you click through, keep a sharp eye out for high-impact design elements and clever conversion triggers.

What to Look For in a Competitor UX Audit:

- Clarity of Value Proposition: When you land on their homepage, is it instantly obvious what they do and who they do it for?

- Call-to-Action (CTA) Design: Are their buttons high-contrast and easy to spot? Is the copy compelling and action-oriented (e.g., "Get My Free Demo" vs. the generic "Submit")?

- Friction in Forms: How many fields are in their lead capture forms? Do they use social proof like testimonials or trust badges nearby to ease anxiety?

- Mobile Experience: How does the site actually feel on a smartphone? Is the navigation intuitive, and are the CTAs easy to tap with a thumb?

This kind of analysis becomes even more critical in regulated industries like cannabis. It can reveal how the top players successfully build trust and guide users toward a purchase while navigating a maze of compliance rules. You might find they use educational content to help with product selection or implement age gates that are clear but not intrusive. Their strategies can provide a blueprint for how to grow safely and effectively in a tough market.

Building Your Winning Action Plan

This is where the rubber meets the road. All that time spent digging through data and pulling insights only matters if it leads to real, tangible action. An analysis that just sits in a folder is nothing more than an expensive academic exercise. Now, it's time to turn what you've learned into a prioritized roadmap your teams can actually run with.

The goal isn't to create a massive, overwhelming to-do list. It's to be surgical. You need to pinpoint the moves that will deliver the biggest bang for your buck and get them into your workflow right away.

Prioritize with an Impact vs. Effort Matrix

The sheer number of potential actions can be paralyzing. You've likely uncovered keyword gaps, content opportunities, UX flaws, and maybe even pricing discrepancies. To avoid getting bogged down, you need a simple framework to sort through the noise.

The Impact vs. Effort matrix is perfect for this. It forces you to evaluate every potential task against two straightforward questions:

- Impact: How much will this actually move the needle on our key business goals (traffic, leads, sales)?

- Effort: Realistically, how many resources (time, money, people) will this take to get done?

Using this lens helps you categorize every opportunity, making it crystal clear where to focus first.

The most common mistake I see is teams chasing big, flashy projects right out of the gate. A well-executed competitive analysis almost always reveals a handful of high-impact, low-effort "Quick Wins" you can tackle this quarter to build momentum and show an immediate return.

Turning Insights into Tangible Tasks

Your findings have to be broken down into specific, assignable tasks. An abstract insight like "our competitor's blog is better" isn't actionable. You have to translate that observation into a clear directive for your team.

This is the process that connects a data point on a spreadsheet to a task on someone’s project board.

Here’s how this plays out in the real world:

Insight: A keyword gap analysis reveals your top rival ranks #2 for "holistic sleep remedies Vancouver," a high-intent term you aren't even targeting.

- Action Plan: Assign the content team to create a comprehensive, 2,500-word guide on that topic. The task should include a detailed content brief outlining the SERP features to win, user intent to satisfy, and an internal linking strategy.

Insight: You notice a competitor's e-commerce checkout has a one-click payment option, while yours is a clunky five-step process.

- Action Plan: Create a ticket for the dev and CRO teams to scope and A/B test a streamlined checkout flow, starting with integrating express payment options like Apple Pay or Shop Pay.

Insight: A rival just got featured in a major industry publication, which is now driving significant referral traffic and high-authority backlinks their way.

- Action Plan: Task your PR or marketing manager to dissect the featured article's angle. Then, have them pitch three similar—but unique—story ideas to a curated list of target publications.

Establish KPIs to Measure Success

An action plan without a way to measure success is just a wish list. If you don't define your key performance indicators (KPIs) upfront, you'll have no idea if your efforts are actually working. Every task you assign needs a corresponding metric.

Sample Action Plan with KPIs

| Action Item | Team Responsible | Primary KPI | Secondary KPI | Target Date |

|---|---|---|---|---|

| Create 3 new blog posts on gap keywords | Content/SEO | Organic rankings for target keywords | Organic traffic to new posts | End of Q2 |

| A/B test a single-page checkout | CRO/Dev | Conversion rate improvement | Cart abandonment rate reduction | End of July |

| Launch a targeted link-building campaign | SEO/PR | Number of new referring domains | Domain Authority increase | End of Q3 |

This kind of structure creates accountability and gives you a clear benchmark for success. Checking in on these KPIs regularly is crucial—it tells you what's working and where you might need to pivot. This feedback loop is what transforms your competitive analysis from a one-time project into a continuous cycle of improvement, ensuring you stay agile and always one step ahead.

Common Questions About Competitive Analysis

Even with a solid plan, questions always pop up once you get your hands dirty with competitive analysis. It’s only natural to wonder if you’re focusing on the right things or if your timing is off. Let's run through some of the most frequent questions I hear, so you can refine your process and move forward with confidence.

Getting these basics sorted helps demystify the whole thing, turning it from a monster of a task into a manageable—and essential—part of your strategy.

How Often Should I Conduct a Competitive Analysis?

There isn't a single magic number here; it really depends on how fast your industry moves. For most businesses, a comprehensive, deep-dive analysis is something you should tackle once a year. This gives you a chance to step back and get a clear view of the major strategic shifts happening in your market.

But here’s the thing: relying only on an annual report is a huge mistake. The digital world just moves too quickly for that. This is why ongoing monitoring is absolutely critical to staying agile.

I always recommend scheduling quarterly check-ins focused on a few specific areas:

- Keyword Rankings: Keep an eye on any movement for your most important commercial intent keywords.

- Ad Campaigns: Check out the Meta Ad Library for new ad creative, offers, or messaging.

- Content Launches: Take note of any significant new guides, studies, or resource hubs your competitors are pushing out.

If you’re in a fast-paced sector like e-commerce or tech, you might even want to tighten that up to monthly monitoring of your top three rivals. This cadence ensures you're being responsive, not just reactive, to new threats and opportunities.

What Are the Best Free Tools for Competitive Analysis?

While the big paid tools offer incredible depth, you can uncover a surprising amount of intelligence without spending a dime. Your budget should never be a barrier to understanding what your competition is up to.

You can actually build a pretty powerful free toolkit to get started. Just using Google in an incognito window gives you unbiased search results, and setting up Google Alerts is a simple way to track competitor brand mentions and PR wins.

Don't underestimate the power of free, publicly available resources. The Meta Ad Library, for instance, provides a direct look into your competitors' social ad strategy, showing you their exact messaging, creative, and calls-to-action. It's a goldmine.

Other fantastic free resources include AnswerThePublic, which literally shows you the questions your audience is asking online. Even the free versions of comprehensive tools like Ubersuggest offer a solid starting point for keyword and content research.

How Do I Analyze Competitors in a Regulated Industry?

When you operate in a regulated space like cannabis, CBD, or finance, your analysis needs an extra layer of scrutiny. It's not just about figuring out what works; it's about figuring out what works within the rules. A standard analysis that ignores compliance isn't just incomplete—it's downright risky.

Your focus should shift to how top competitors are successfully navigating these restrictions.

- Are they leaning heavily on educational content and SEO because direct advertising is limited?

- What kind of disclaimers and on-site language are they using to stay compliant?

- How are they building trust and authority without making prohibited health claims?

The goal here is to reverse-engineer their compliant growth strategies. By seeing how they manage to thrive within a tight regulatory framework, you can identify safe, effective tactics to adapt for your own brand.

My Competitors Are Much Larger. How Can I Realistically Compete?

Facing off against a massive, well-funded competitor can feel intimidating, but it’s far from an impossible fight. The key is to stop trying to compete on their terms. Don't even think about outspending them on ads or trying to match their colossal content volume. Instead, your analysis should be laser-focused on finding their weaknesses.

Large companies are often slow-moving and tend to ignore smaller, niche market segments. That's your opening. They might completely overlook long-tail, high-intent keywords because the search volume seems too low for them to bother with. For you, that's a goldmine of qualified traffic. They may have a huge budget but an impersonal, automated customer service experience. Your agility and ability to offer a personal touch suddenly become a powerful strategic advantage.

Compete where they're weak, not where they're strong.

Ready to turn these insights into a dominant market strategy? The expert team at Juiced Digital uses AI-powered analysis to uncover your competitors' weaknesses and build a data-driven plan for your growth. Start with a free consultation by visiting us at https://juiceddigital.com.